Do you pay with Google Pay? So you want to peruse this news

Google Pay New Rules: Google is making changes to the installment managed according to the rules of the Reserve Bank of India (RBI) which will unmistakably influence the clients of online installments. Assuming that you additionally pay on the web, you should peruse this news cautiously.

Online installment: If you additionally pay online through Google Pay, you should peruse this news cautiously. Google is changing the installment runs according to the rules of the Reserve Bank of India (RBI). The new principles apply to all Google administrations, including Google Ads, YouTube, Google Play Store and Google Pay.

Google won't save client card subtleties, for example, card number and expiry date from January 1, 2022. Up until this point, Google has been saving the card subtleties of its clients. Up until this point assuming any client pays he simply needs to enter the CVV number of his card.

Be that as it may, from January 1, clients should fill in the card number, expiry date and other data at the hour of every installment when making on the web installments. Allow me to let you know that with the RBI's drive to ensure touchy data, rules have been given for not securing card data.

Assuming you use Visa or Mastercard, you really want to approve to save the card data on Google Pay in another organization. Clients will actually want to make a one-time manual installment with their current card subtleties. Clients will actually want to make installments according to the current guideline till December 31, 2021. From January 1, 2022, when making on the web installment, card number, expiry date and other data should be filled in at every installment.

Assuming you utilize a RuPay, American Express, Discover or Diners card, your card data won't be saved by Google after December 31, 2021. The new arrangement doesn't uphold these cards. So you need to enter the card subtleties for every one of the manual installments by first January 2022.

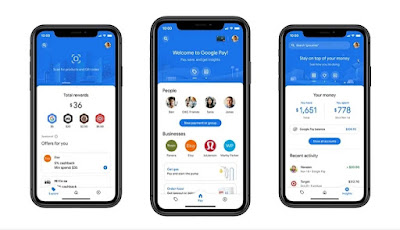

Make UPI installments, re-energizes, cover bills and organizations with Google Pay (Tez)source television 9news

Make UPI moves or do portable re-energizes, bills and installments to organizations with your ledger with Google Pay, a straightforward and secure installments application by Google.

Join crores of Indians who are utilizing Google Pay for all their installment needs. Allude companions, get the most recent offers and procure awards as you pay.

You should simply connect your financial balance on this application with your enrolled versatile number and start the experience.

UPI ID is an exceptional ID that is utilized to make UPI installments instead of ledger subtleties.

ગુજરાતી માં વાંચવા અહિ ક્લિક કરો news રિપોર્ટ વાંચો

UPI PIN is like your Debit Card PIN, a 4 or 6 digit number that should be set by you while making your UPI ID. Kindly don't share your PIN.

+ Various layers of safety from your bank and Google

Your well-deserved cash is kept securely in your financial balance and you have to command over cash leaving your bank account*. With a top-notch security framework that identifies misrepresentation and hacking, we are focused on keeping your cash safe and we work with your bank to ensure your installment data.

Every exchange is gotten with your UPI PIN, and you can protect your record with a gadget lock technique like your unique finger impression.

*Google Pay works with all banks in India that help BHIM UPI.

+ Helpfully pay DTH, broadband, power, FASTag, LPG bills and that's only the tip of the iceberg

You just need to connect your biller accounts once, we remind you consequently to take care of your bill with only a couple of taps. Google Pay works with billers the nation over.

+ Find the most recent paid ahead of time re-energize plans and effectively re-energize your versatile arrangement

Re-energize any prepaid portable in less advances and at zero expense. Observe the best and most recent re-energize designs just as rehash re-energize in one tap.

+ Check your financial balance

No compelling reason to visit the ATM to see your bank balance, immediately view it whenever, without any problem.

+ Get compensated

Allude companions, get offers and bring in money compensations into your financial balance as you pay.

+ QR code installments

Pay through the QR code scanner at your most loved disconnected shops and dealers.

+ Book flights, transport, train tickets, shop on the web and request suppers

Request your beloved food and book your movement effectively inside the application or on accomplice sites and applications. Accomplices incorporate Zomato, redBus, MakeMyTrip and so on

+ Quick and secure installments with your charge and Visas

Add and connection your charge and credit cards** on Google Pay and use them for:

- Online installments (versatile re-energizes or with online applications like Myntra).

- Disconnected installments (at disconnected shops by tapping your telephone on NFC terminals)

**Administration is carrying out across bank backers and card network suppliers.

+ Purchase, sell and acquire 24K Gold

Exchange gold safely with rates upheld by MMTC-PAMP. Gold is safely saved in your Gold Locker on Google Pay, or conveyed as gold coins to your home. New! You would now be able to procure gold as Google Pay rewards.

ગૂગલપે ડાઉનલોડ કરવા અહી ક્લિક કરો

+ Send cash straightforwardly from your financial balance to any ledger, including the individuals who are not on Google Pay, by means of UPI moves

Utilizing NPCI's (National Payments Corporation of India) BHIM Unified Payments Interface (BHIM UPI), cash moves are straightforward and secure with Google Pay.

No comments:

Post a Comment

If you have any doubt let me know